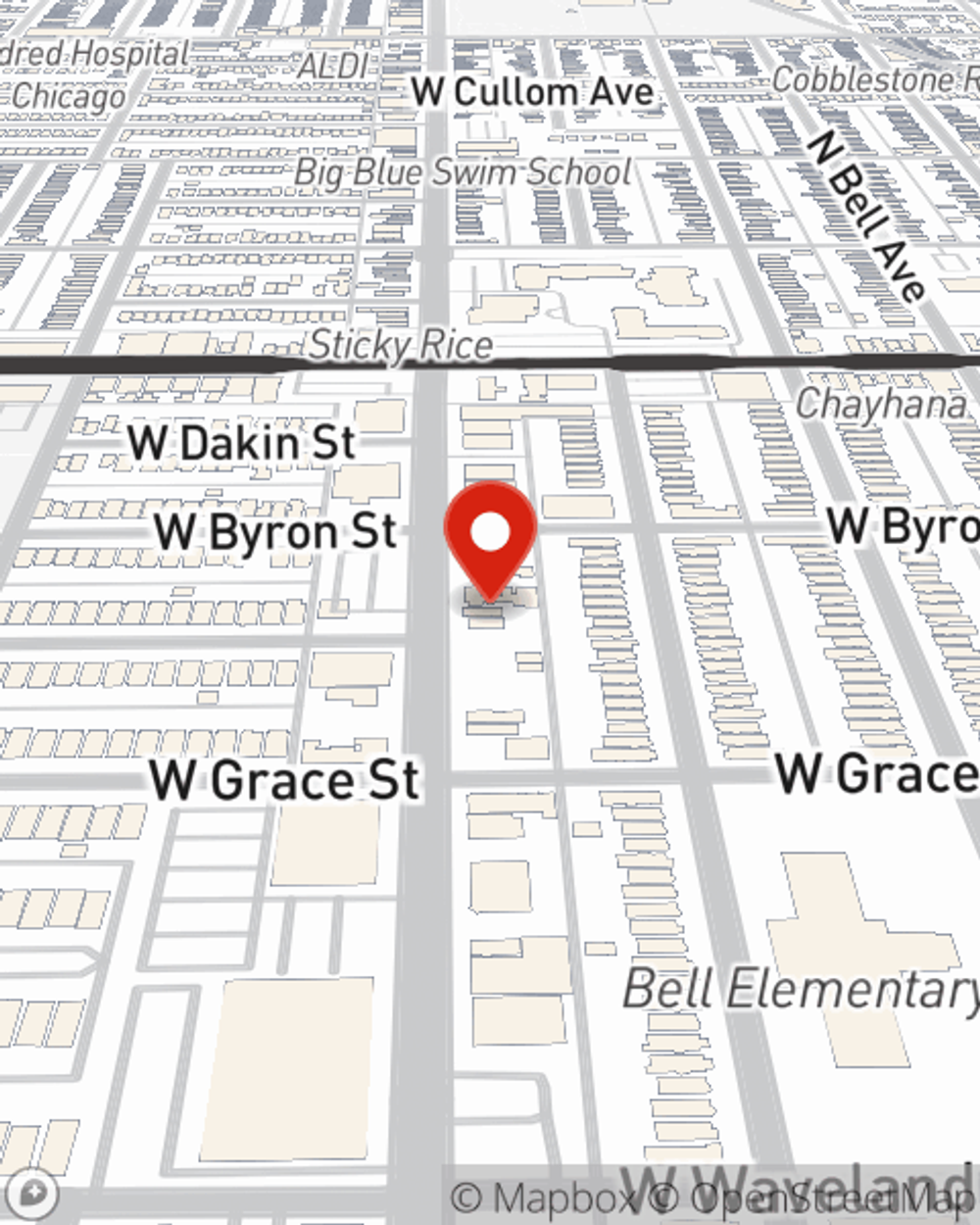

Renters Insurance in and around Chicago

Your renters insurance search is over, Chicago

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Lakeview

- Lincolnwood

- Skokie

- Niles

- Oak Park

- Evanston

- Wilmette

- Glenview

- Morton Grove

- Lincoln Square

- Edgebrook

- Lincoln Park

- Chicago

Calling All Chicago Renters!

It may feel like a lot to think through your sand volleyball league, family events, work, as well as savings options and coverage options for renters insurance. State Farm offers no-nonsense assistance and impressive coverage for your furnishings, sports equipment and appliances in your rented property. When the unexpected happens, State Farm can help.

Your renters insurance search is over, Chicago

Renters insurance can help protect your belongings

Safeguard Your Personal Assets

You may be doubtful that Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the house. How much it would cost to replace your stuff can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when unexpected mishaps occur.

If you're looking for a value-driven provider that can help with all your renters insurance needs, call or email State Farm agent Hemina Patel today.

Have More Questions About Renters Insurance?

Call Hemina at (773) 267-0303 or visit our FAQ page.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Hemina Patel

State Farm® Insurance AgentSimple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.